Black Friday may have kicked off the shopping season, but December is where the magic happens. With Christmas just around the corner, shoppers are searching for gifts, decorations, and deals to make the season bright. For businesses, this is the perfect time to double down on strategy and capture the festive buzz.

Missed out on capitalizing Black Friday trends? No problem! The festive momentum is still in full swing, and Ask Arlo is here to guide you. Powered by real-time GenAI, Arlo can reveal your hottest holiday trends and competitor insights.

We’ve asked our little helper for the inside scoop on Christmas search trends!

Wrapping up the holidays

Christmas isn’t complete without the perfect wrapping paper, and it’s clear that shoppers are searching high and low for the best options this season.

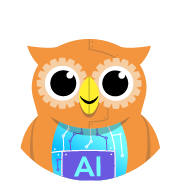

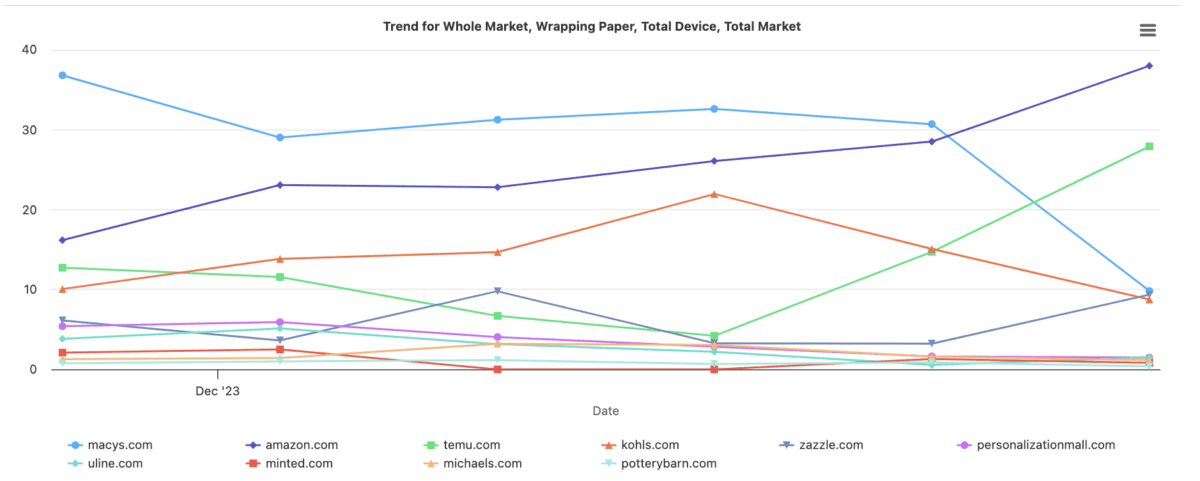

Ask Arlo dove into the numbers, analyzing the competitive landscape for wrapping paper, and here’s what we found.

“Hey Ask Arlo, what was the trend for “wrapping paper” during the Christmas period?”

- Macys.com: Dominated early on, likely driven by early shoppers getting a head start on Christmas prep.

- Amazon.com: Took the lead mid-December, suggesting last-minute shoppers relying on its speedy delivery.

- Temu.com: Gained significant traction in the final days leading to Christmas, capturing the attention of budget-conscious shoppers.

Market highlights and key dates

The demand for wrapping paper escalated through the month, peaking on December 17th, 24th, and 31st.

Key dates to watch for holiday trends

- December 17th: The pre-Christmas rush peaked, as shoppers scrambled to finish their gift wrapping.

- December 24th: Last-minute panic buying surged on Christmas Eve.

- December 31st: Post-holiday clearance sales drew bargain hunters.

Who ruled the wrapping paper game?

Amazon.com: The consistent giant

- Steady growth: Amazon.com PPC activity climbed from 16 (Nov 26) to an impressive 38 (Dec 31), dominating the market as the go-to for convenience and variety.

- Strategy: Amazon.com targeted both proactive early shoppers and late-season bargain hunters, leveraging its unmatched delivery speed.

Macys.com: A strong start, but a weak finish

- High engagement early on: Macys.com started as the leader on November 26th (37), maintaining a steady presence through mid-December.

- December 31st drop: A steep decline to 10 on the last day of the month suggests they deprioritized PPC post-Christmas, likely pivoting budget elsewhere.

Christmas lights to brighten up the holiday season

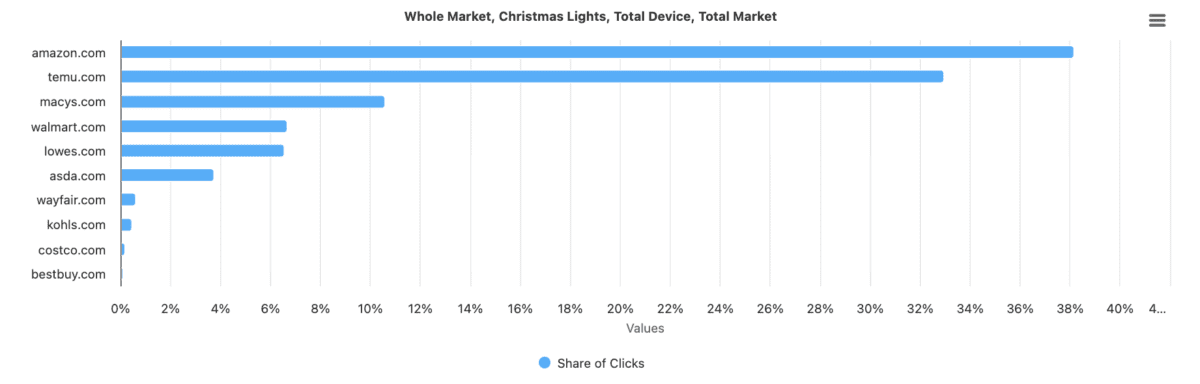

As the Christmas lights twinkle across neighborhoods and storefronts, the search for festive lighting continues to shine in the retail market.

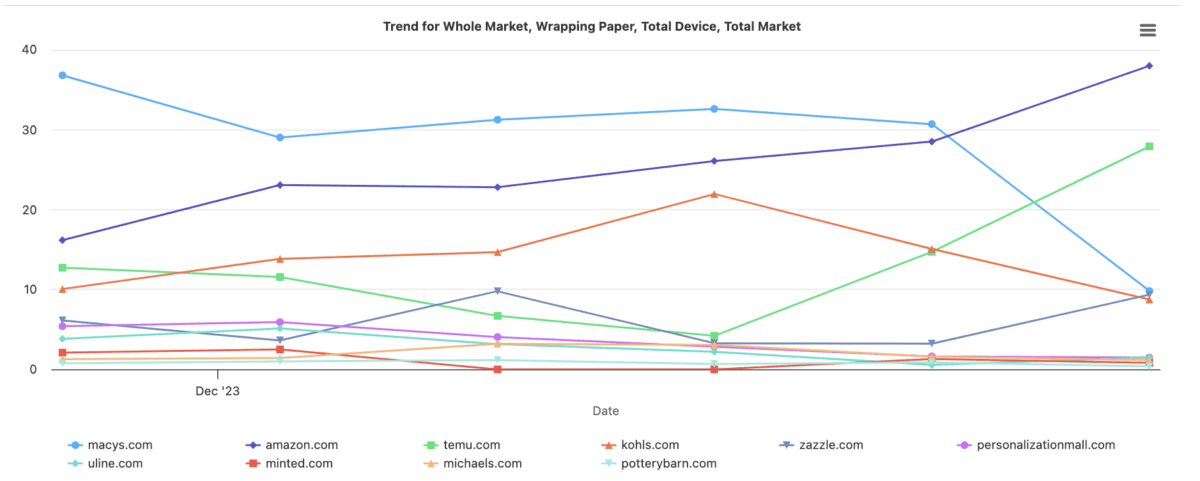

What did Ask Arlo uncover about how retailers are performing in the competitive Christmas lights space?

“Ask Arlo, can you dive into the competitive landscape for the search term Christmas lights”

- Amazon.com led with 2.4 million impressions, capturing 38% of the click share. Their average ad position was 20, reflecting strong visibility in search results.

- Temu.com was a close competitor, slightly ahead with 2.6 million impressions. Despite a slightly better average position of 14.8, Temu secured 33% of the click share. They allocated 46% of their spend to aggressive bidding strategies.

“Hey Ask Arlo, what titles are Amazon.com using for keyword “Christmas lights” during the christmas period and what are the differences between how competitors position their products?”

- Brand emphasis: Titles like “Amazon.com® Official Site” reinforce Amazon’s authority and trustworthiness.

- Promotional highlights: Phrases like “Amazing deals and discounts” and “Black friday week” create urgency and attract budget-conscious shoppers.

- Product variety and availability: Ads such as “Huge in-stock Inventory” emphasize the vast product selection, reassuring customers of availability.

- Specific product promotions: Targeted phrases like “Shop stocking stuffers” and “Explore top gifts” focus on popular holiday shopping categories.

- Strong call-to-action (CTA): Direct CTAs like “Shop now” and “Order today” encourage immediate action from shoppers.

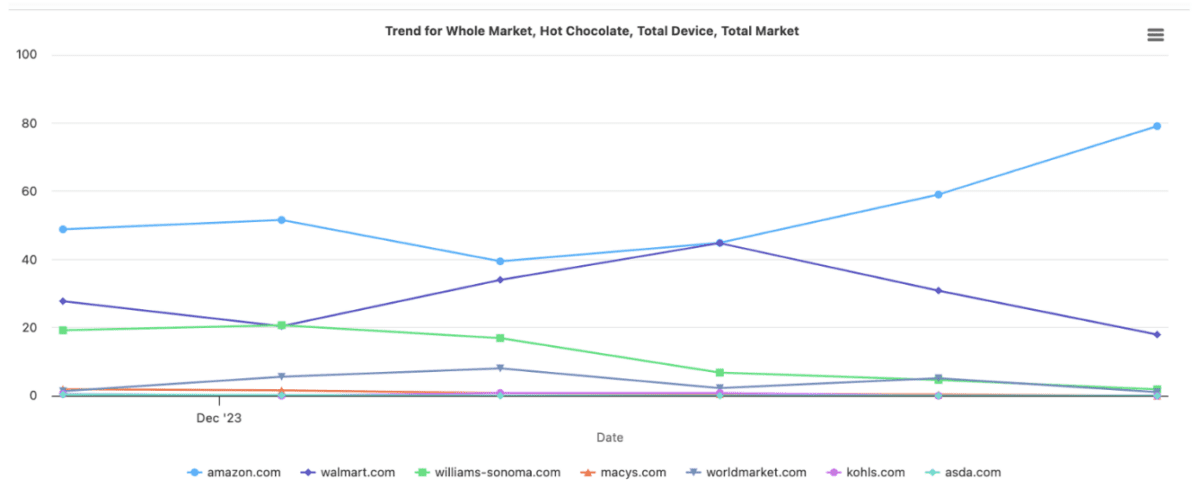

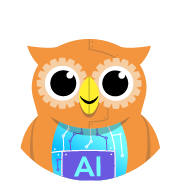

Hot chocolate search trends

As the holiday chill set in, the search for cozy, comforting treats like “hot chocolate” surged across online platforms.

Let’s Ask Arlo for insights into the “hot chocolate” trend.

“Ask Arlo, can you show me the trend for “hot chocolate” during the Christmas period?”

- Amazon.com: Dominated PPC for “hot chocolate,” peaking at 79 on December 31 with a strong holiday ad strategy targeting early and last-minute shoppers.

- Walmart.com: Peaked mid-season at 45 on December 17 but scaled back efforts toward year-end.

- Williams-Sonoma.com: Reduced PPC activity from 21 on December 3 to 2 by December 31, likely shifting focus to organic traffic or other promotions.

Closing the holiday search trends with Ask Arlo

Ask Arlo simplifies the complex world of holiday search trends, giving you real-time insights to adapt and thrive in a competitive landscape. Whether it’s capturing the early rush or capitalizing on last-minute shopping spikes, Ask Arlo our little GenAI helper can refine your strategy to make smarter, data-driven decisions.

Got a question? Go deep in the data with Ask Arlo.

Take an interactive tour of Ask Arlo or get in touch with a search consultant to book a demo.