Navigating the complex landscape of pharma PPC requires a unique approach. Adthena’s Director of US Agency, Tom Larkin, sat down with Mike Ott, VP of Paid Search, at agency Klick Health to uncover the challenges and opportunities in this space. This conversation explores the impact of AI, key industry limitations, and how to overcome them.

Mike, a seasoned digital marketing expert with over eight years of experience specializing in pharmaceutical advertising, offers unique insights into managing large SEM accounts.

Tom: How is AI reshaping PPC strategies in the pharmaceutical industry, and what does the future hold for search advertising in this sector?

Mike: AI is a versatile tool that can serve as a research platform and aid automation. However, to apply it strategically, it’s important to first dissect what’s happening in the pharma landscape and understand where the advertising opportunities are.

AI is influencing how search engines like Google and emerging platforms like ChatGPT are shaping user behavior. For example, in May 2024, Google announced the introduction of AI overviews in its search results. While we’re seeing trends like long-tail queries and question-based prompts, keyword targeting isn’t vastly impacted due to match types.

However, the potential for advertising on platforms like Perplexity could be a game-changer. While there are many variables in search advertising impacting the industry, it’s crucial to stay on top of these changes and adapt our marketing strategies as needed.

Tom: What challenges do your teams face when executing PPC campaigns for pharmaceutical clients?

Mike: The easy answer is regulation. FDA guidance can create limitations, and vendors like Google and Microsoft introduce new features or targeting mechanisms that aren’t eligible for pharmaceutical advertisers because of industry constraints. We’re boxed into these limitations, but we’re also experts in this area so we understand the guidelines and have found effective ways to maneuver within them to deliver efficient results.

A bigger challenge is unpacking the value our marketing dollars provide and proving ROI. Unlike e-commerce, we rely on proxies and models to measure value. It’s complex, but crucial for optimizing campaigns.

Tom: So is it about better attribution, Mike?

Mike: Attribution plays a part, but, for us, it’s more about using third-party platforms to anonymize data. Due to regulations, we can’t do one-on-one targeting, so we rely on partner programs to build models that demonstrate different channels’ impact on prescribing behaviors.

Tom: How is your agency leveraging AI to enhance PPC and search marketing efforts?

Mike: We’re looking at AI as a tool for efficiency, but not necessarily to replace traditional automation in PPC and search marketing. We evaluate where AI can make a difference and where traditional methods still work best. Currently, we consistently use AI as a research tool and see opportunities in asset development, reporting, and insight gathering.

Tom: How has behavior in the pharmaceutical market evolved in recent years? How have you adapted your PPC strategies accordingly?

Mike: I’m not sure “evolved” is the right word for our industry. Users consistently progress their knowledge about health conditions. This behavior hasn’t changed. However, we see trends in the type of information searched, such as access to treatment and financial support, especially in light of economic conditions. We adapt our strategies accordingly by optimizing landing pages for relevance and meaningful engagement and highlighting clients’ financial support programs more.

Tom: How do you adapt your PPC strategy when competing drugs are approved?

Mike: There’s no one-size-fits-all strategy. Our process involves researching and understanding both our clients’ brands and new competing drugs. We conduct SWOT analyses to identify targeting opportunities and messaging strategies based on these insights. It’s about understanding the market and adjusting our approach accordingly.

Tom: Regarding managing multiple brands that treat similar indications, how do you deploy swim lanes that favor a particular drug?

Mike: We start by understanding each brand and its differentiators. Clients don’t typically launch multiple brands with the same indication and no differences. We identify nuances and create distinctions for each brand’s targeting. There’s always shared space where all brands can find value, but we prioritize and navigate, to efficiently manage cannibalization. This involves detailed conversations with clients and strategic planning.

Tom: What do you leverage to target the right audiences at the right time?

Mike: Data is crucial. We use front-end metrics like clicks and costs, analytics programs to see website interactions, and third-party platforms to anonymize data and provide insights on prescription lifts. Additionally, we use tools to validate when we’re reaching healthcare professionals. This comprehensive approach helps us optimize our campaigns based on meaningful data.

Your next steps using actionable insights

Mike’s insights into the challenges and opportunities in pharma are invaluable for marketers seeking to optimize their campaigns in this space.

How might you consider applying these insights to your PPC strategy?

- Evaluating your current PPC strategy in light of AI advancements

- Prioritizing data collection and analysis for informed decision-making

- Developing a flexible approach to accommodate industry changes

Let’s take a look at what Adthena data says:

1. Market Trends

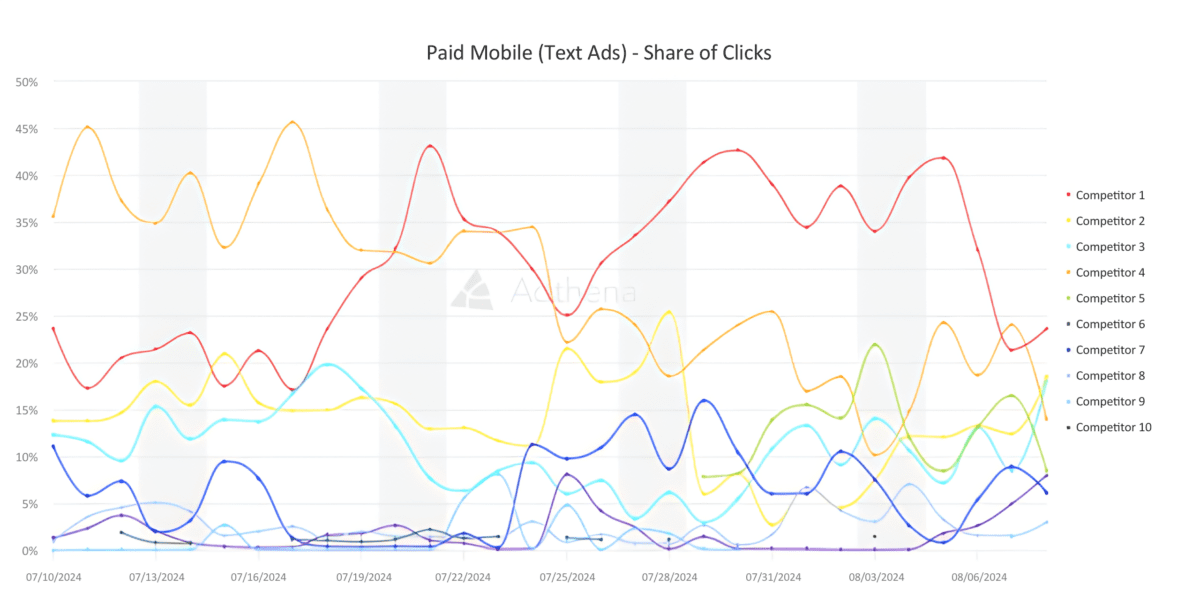

An insight taken from the Adthena platform showing Pharma competitors and their Share of Clicks for Mobile Text Ads during the last 30 days.

Adthena’s Market Trends provides valuable insights into competitor behavior. For example, you can easily identify significant shifts in market share, such as when Competitor 1 surpassed Competitor 4 by substantially increasing their ad spend. Adthena also uncovers hidden competitors, like the domain masked by Google as a Prescription Treatment Website. You can also track the performance of new entrants, such as Competitor 5, which has gained significant click share in the past week.

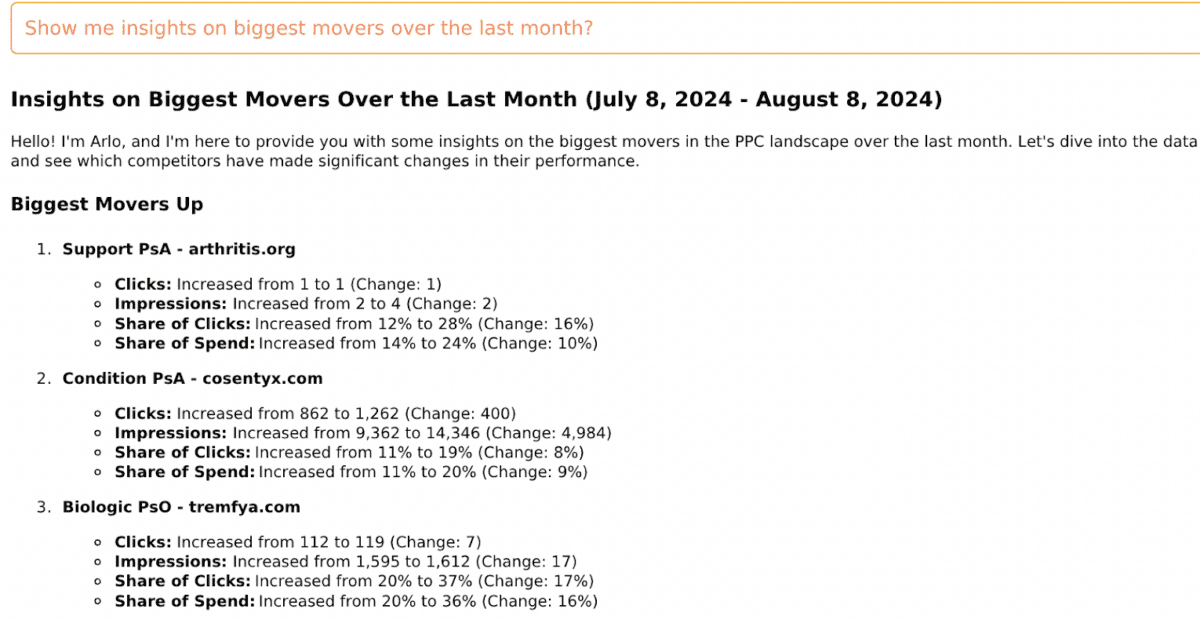

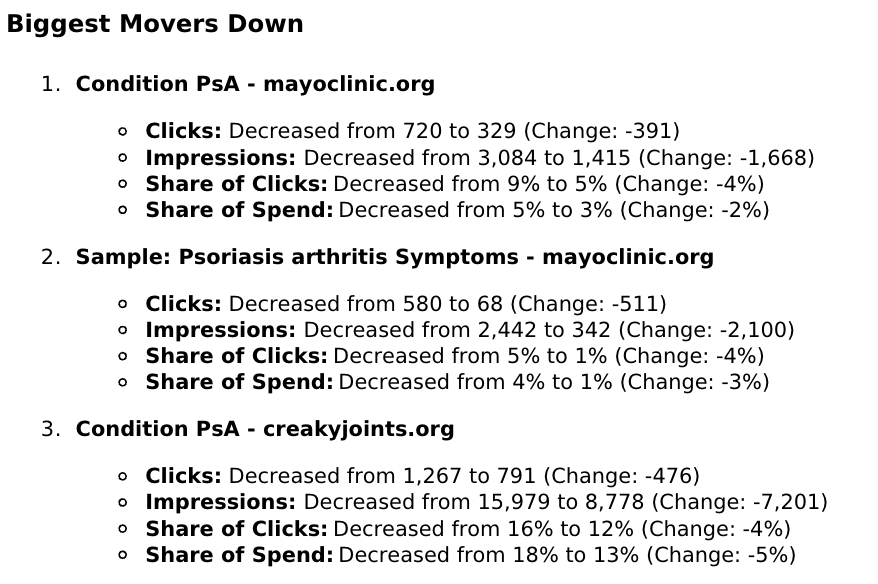

2. Ask Arlo who the biggest movers are in your market

Adthena’s GenAI data analyst, Ask Arlo, can help you with whatever question you have about your market landscape and answer it in real time. Using the example below, you can easily identify the biggest movements for your account.

Ask Arlo can help you understand the competitive dynamics and adjust your PPC strategies accordingly.

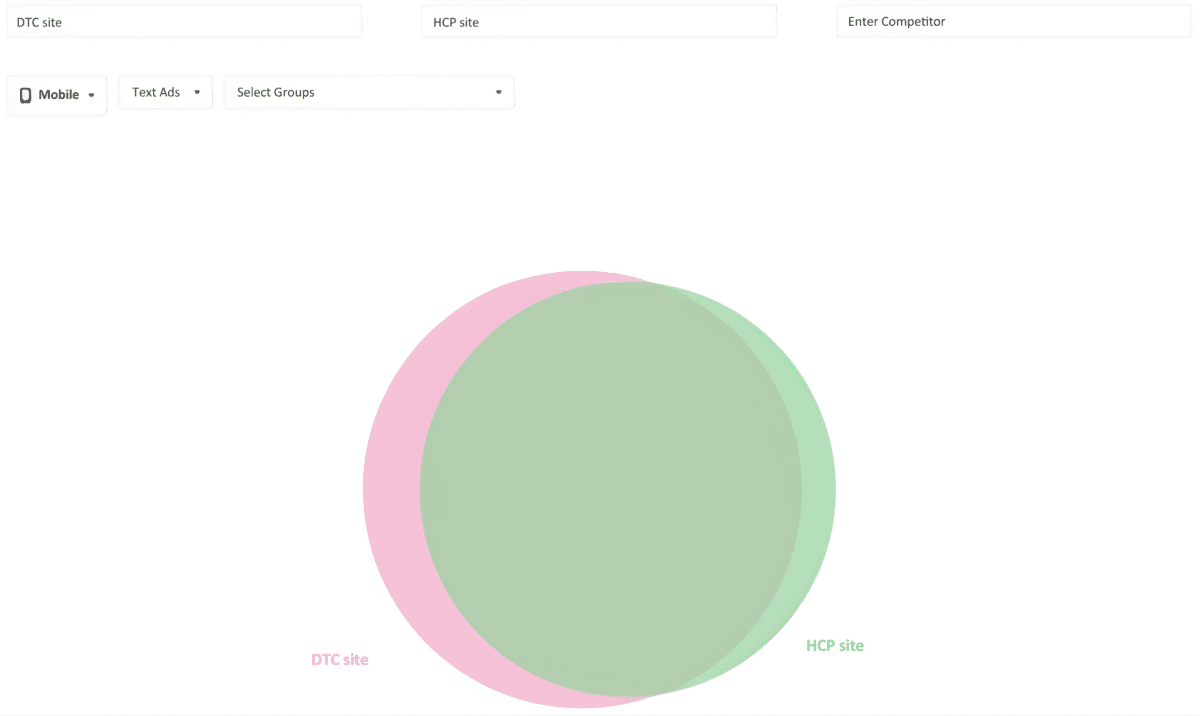

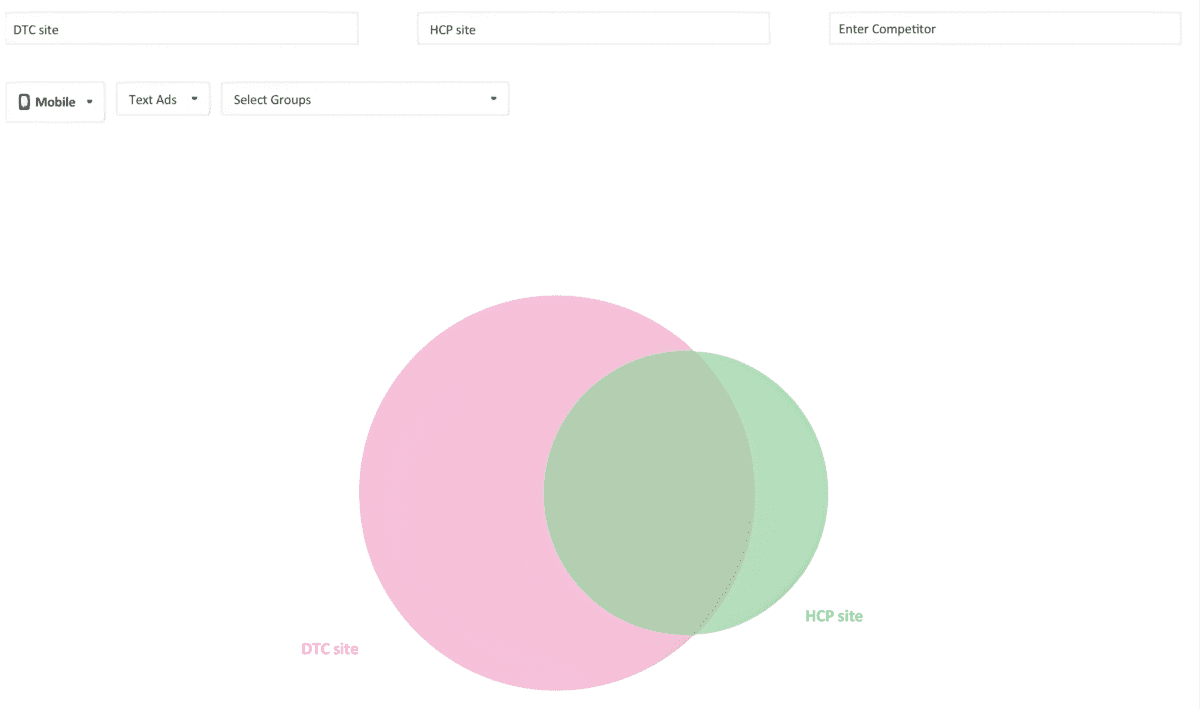

3. DTC and HCP domains

Google’s restrictions and the “Prescription Treatment Website” regulation create significant visibility challenges when tracking competitors. Adthena’s Head to Head comparison tool analyzes search term overlap between DTC and HCP domains. By identifying opportunities to optimize budgets and reduce CPCs, pharma brands can effectively manage their online presence.

Pharma brands use Direct to Consumer, Healthcare Professional and Disease State Awareness sites strategically to maximize SERP visibility. Some aim for SERP dominance with multiple domains, but this can inflate CPCs. Others establish swimlanes between domains to target a broader range of search queries.

See above for Competitor A

The above example shows Competitor A operating with clearer swimlanes, with a smaller percentage of overlap in their search term coverage compared to Competitor B, who choose to utilize both domains on the same set of searches to maximize their presence.

This tool empowers Pharma brands to understand competitor search behavior, enabling informed decision-making and improved campaign performance.

Want to learn how to optimize your pharma PPC campaigns?

Navigating the complexities of pharma PPC requires a nuanced approach. For pharmaceutical marketers, the insights shared provide actionable steps to optimize your campaigns. By embracing AI advancements, leveraging data for smarter decision-making, and adapting to regulatory and market shifts, you can significantly enhance your PPC strategy.

To learn more about your specific challenges, request a personalized demo today.