Play to win: The competitive search landscape of gaming

Our benchmark data reveals a number of global search trends, and category-specific insights. Growth in the paid search sector can be a double-edged sword for gaming advertisers. Naturally there will be plenty of opportunity for advertisers, however, growth also signals increased competitiveness on the search engine results page (SERP), and the many challenges that accompany such change vary by industry.

Here, we explore the strengths and weaknesses with the search landscape of gaming to tell you about how such factors are affecting advertisers in search.

Ad spend & performance

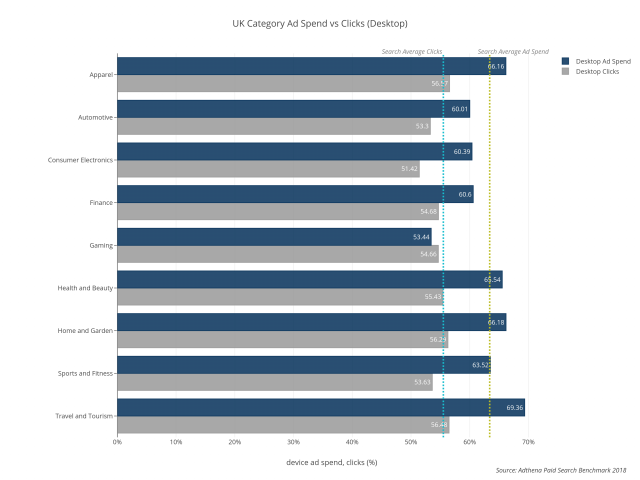

Desktop: UK ad spend vs share of clicks

The majority of categories see greater proportionate ad spend on desktop search. Again it’s the retail categories, along with travel and tourism, that invest more than the search industry average into desktop campaigns. Gaming, a category with notoriously high cost-per-click (CPCs), invests 53% of its ad spend on desktop, significantly less than any other category.

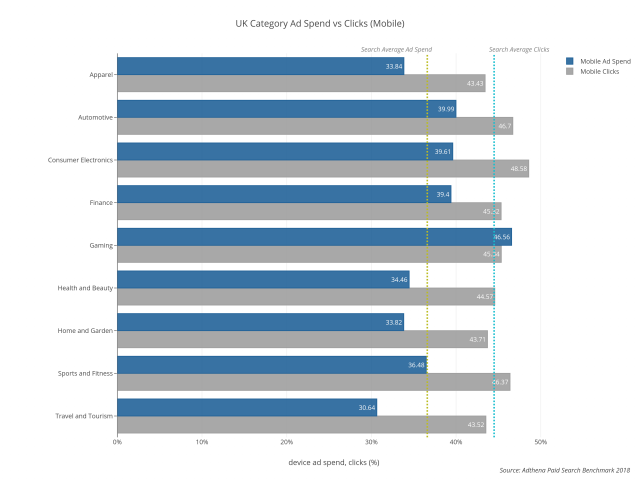

Mobile: UK ad spend vs share of clicks

As is the case in the US, advertisers in the UK receive a greater proportionate share of clicks on mobile per unit of ad spend. Advertisers in gaming invest 47% of their ad search spend in mobile, well above the industry average, and receive a near equivalent share of clicks (45%).

Cost and Competition

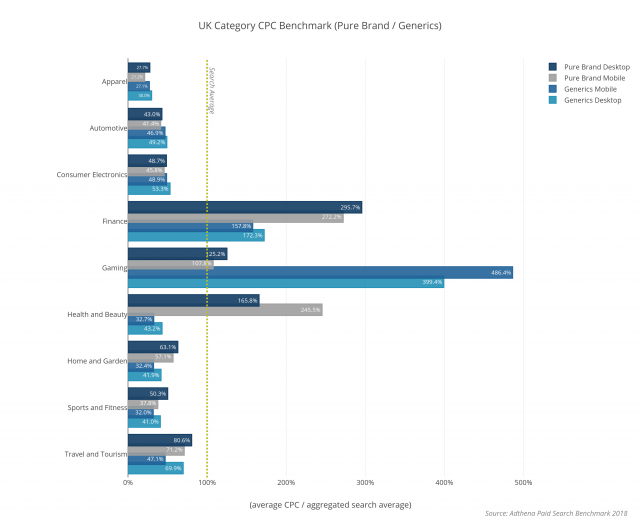

Avg CPC, by device, pure brand and generics search terms

Although overall the retail categories, along with travel and tourism have broadly uniform CPCs that sit below the industry average, Gaming has exceptionally high CPCs on generic search terms. Advertisers in the space can expect to pay 486% times the industry average CPC on mobile generics, and 399% times the industry average CPCs on desktop generics.

Top of Page Visibility Cost

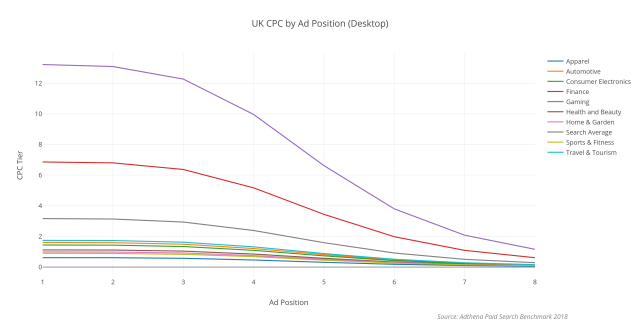

Desktop: Average CPC per ad position

In the UK, search landscape of gaming is the only category to exceed finance in the steepness of cost-per-click cost differential across first page ad positions. Advertisers in gaming can expect to pay twice that of advertisers in finance for a position 1 ad placement.

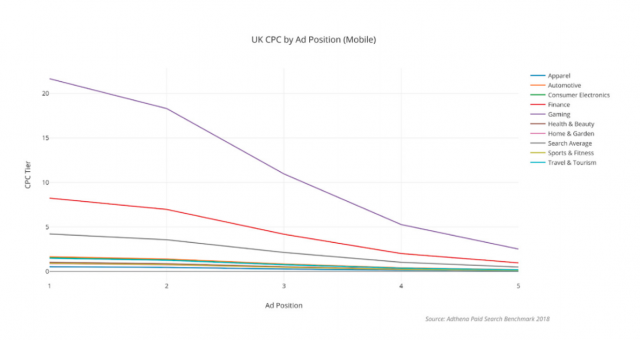

Mobile: Average CPC per ad position

On mobile devices, finance and gaming exhibit a strong indication that a larger CPC bid will be necessary to influence a top four ad position. However these visualizations further illustrate how ‘top heavy’ these categories are. It shows us that advertisers in gaming who are seeking top-of-page search prominence need to pay even greater proportionate ad spend to win a top four result.

It’s well established that gaming in the UK has the highest cost-per-click categories, however these visualizations further illustrate how ‘top heavy’ these categories are. It shows us that advertisers in these categories who are seeking top-of-page search prominence need to pay even greater proportionate ad spend to win a top four result.