This year Prime Day brought with it trends that had market-wide implications, not only for next year’s discount days counter-strategies (and yes, you will need them), but also for the upcoming end-of-year shopping season.

Online shopping is the new normal.

It’s estimated that Amazon’s Prime Day sales grew more than 35% YoY vs. 2019. But more significantly, overall online sales increased 43% YoY in the US in September according to Adobe Analytics; August’s figures were similar. Global data concurs. A survey of about 3,700 consumers in nine economies around the world concludes that the pandemic has changed our online shopping habits forever by accelerating shifts that were already in motion.

It’s vital for PPC marketers to look at Prime Day 2020 not as an outlier, but as a harbinger: discount days and online shopping are here to stay. Here are a few of the most notable trends and what they mean for you this holiday season and in 2021.

It’s a lot bigger than Amazon

Salesforce data show that global online sales rose 69% on Tuesday, the first day of the Amazon Prime Days event this year. That’s excluding Amazon sales.

Clearly shoppers are going online during the Prime Days window to find deals well beyond Amazon, and the event has become a market-wide opportunity for retailers across segments to start snatching up sales focused consumers. This year, retailers launched reductions of their own to get a share of the Prime Day enthusiasm, kick-start the holiday shopping season, and even clear out inventory left languishing by the pandemic.

While some retailers launched sales clearly branded as challenges to Amazon, the majority repackaged their own events as a mid-season or fall sale. Both Walmart and Target held big alternative sales events over the Prime Days period this year, and Best Buy went all-in and kicked off Black Friday promotions early. There has also been a rise in sales tied to membership and loyalty programs by retailers who want to emulate the Amazon members-only model.

The takeaway: To stay competitive and capture sales when consumers are actively looking for deals, all online retailers need some sort of Prime Days strategy. At a minimum, consider these steps:

- Monitor ad copy and discount messaging in the lead up, during, and in the halo after any major sales events to provide a blueprint for your most compelling messaging and offer. For example, the average advertised reduction during Prime Days increased YoY in 2020. In the US and UK, 50% off was the most popular discount promoted, but the discount amount that most resonated with consumers was between 10-20%. Tracking competitor offers will help you benchmark your own for success.

- Closely analyze trends and search term shifts to spot hot categories and capitalize on changing user tastes and behavior. For example, Google searches for “Roomba,” one of the bestselling Prime Days items, ticked significantly upward starting on November 11, indicating early interest in this popular brand beyond Amazon.

- Investigate the competitive landscape to see who’s bidding on what and at what price. Use this intel to either conquest competitors or identify alternative, less combative terms where you can dominate.

Free Google Ads levelled the playing field

As the first Prime Day since Google democratized its ad listings policies, smaller retailers had an opening unavailable in the past.

Google announced in April that product results on the Google Shopping tab in the U.S. will comprise mostly free listings, giving small and mid-sized sellers a fighting chance against Amazon and eBay. In June, they extended free listings to the main Google Search results page in the U.S. While this may not have moved the needle when it comes to Prime members, who typically start their searches at Amazon, it likely helped retailers pick up mindshare and sales from non-member shoppers looking for Prime Day-inspired deals.

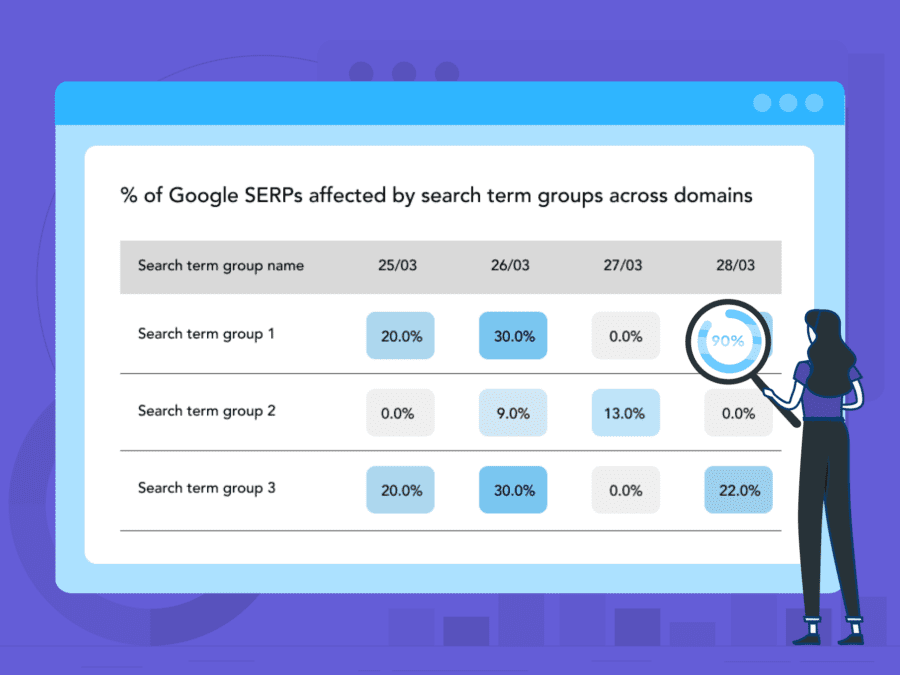

The takeaway: This development means the SERP landscape is set to change. PPC advertisers and those now augmenting PPC with free ads must track their competitive landscapes carefully and adopt tactics that address this new mix, such as:

- Review the different search terms your products can appear on and, where necessary, utilize negatives to capture buyer intent.

- Update and optimize the fields in your product feed to ensure breadth and relevancy to all user searches.

- Track competitor RRPs to identify the optimal buying range for your users, when to start discounting, and how many similar products you’re competing against.

While you were looking the other way: Luxury launches

As retailers were focused on the upcoming Prime Day threat and how to compete with Amazon’s bargains, Amazon made a dash to target shoppers looking for chic, not cheap. In September, Amazon launched its Luxury Stores concept. These stores provide a place for luxury brands to maintain a high-end shopping experience elevated from the counterfeiter crowd with the Amazon convenience shoppers enjoy. Amazon has struggled with this niche in the past because of its poor policing of counterfeiters, but this move may represent a turning point.

As with many retail segments and despite economic uncertainty, online sales of luxury goods have been soaring since 2019, and luxury marketers should take note of how Amazon is now courting this vertical. Amazon’s Luxury Stores kicked off as an invitation-only store within a store, for select Amazon Prime customers, with a limited selection of brands, enhanced flexibility for retailers, and interactive features to distinguish the shopping experience.

The takeaway: The Luxury Stores cohort remains small but demands monitoring. Whether you are thinking of opening an Amazon store or not, it’s wise to utilize a competitive intelligence tool to track brands who are participating, monitor ad copy and messaging, and look for resulting threats and opportunities in the PPC landscape.

Next up, Black Friday

Ready for the end-of-year shopping season? Prime Days data may offer a preview of what’s to come. The best-selling products around the world were hardly surprising and include many of the items that flew off the shelves all summer. In-demand products were dominated by Amazon gift cards, electronics like the Amazon Echo and related smart home devices, robotic vacuums, high-end face masks, exercise bikes, and the like. We’ll have more on the hot product trends soon in our upcoming Black Friday preview (watch this space!)

Some retailers also took the opportunity to offload products that have dropped in popularity in light of the Zoom revolution and comfort dressing aesthetic. Dresses and bottoms received large discounts while reductions for sleepwear (the new business casual) were shallower.

You might want to check out this post for a look at how retailers changed gears to meet COVID-driven demand for fitness apparel over the summer.

These Prime Day trends offer a glimpse into the future of online retail. With everyone moving online, company and consumer alike, the best way to keep your strategy ahead of the curve and messaging compelling, is with real-time competitive intelligence, market monitoring, and data to drive your search strategy. For insights into your specific market landscape and competitors, reach out to one of our industry consultants who’ll be glad to answer your questions.