The Consumer Financial Protection Bureau (CFPB) has introduced new guidance that could reshape digital marketing strategies for financial products in the United States. This change is expected to have significant implications, not just for financial institutions, but for the entire landscape of digital marketers, lead generators, and comparison websites.

Many US finance companies are increasingly concerned about revenue losses from lead generation in the wake of this regulatory shift. As financial institutions rely heavily on third-party lead generators, any disruption in this channel could significantly impact their bottom line.

Learn what these upcoming changes are, what they mean for the financial and marketing sectors, and the steps advertisers can take to minimize the impact on their business.

The bottom-line impact

The new regulations will not only affect marketing strategies but also impact key business metrics, particularly in sectors like finance and insurance:

- Cost per acquisition (CPA): Stricter targeting and compliance requirements will likely increase CPAs, as digital marketing strategies become less efficient and less targeted.

- Return on ad spend (ROAS): With compliance costs on the rise and narrower, less engaged audiences, ROAS may decrease, pushing financial marketers to optimize more diligently across their ad networks.

- Conversion rates: The new compliance guidelines could lead to lower conversion rates, especially in highly regulated sectors like finance, where personalized search ads might no longer be feasible.

- Revenue: Reduced consumer engagement, coupled with stricter ad requirements, could drive down overall revenue, particularly in sectors like automotive and travel.

CFPB guidance and their impacts on digital marketing in financial institutions

1. Increased scrutiny and transparency in lead generation & comparison sites

The CFPB’s new guidance targets both lead generators and comparison shopping websites, holding them accountable if they prioritize higher-paying providers over consumer benefits. These platforms will now need to be more transparent about how they rank and display financial products.

Impact on advertisers:

Financial institutions will need to focus on direct advertising strategies and be more selective about marketing partners. Comparison sites and lead generators must prioritize consumer benefit, which could increase costs per lead and acquisition. Transparency will also become a priority, requiring marketers to adjust messaging and disclosures.

2. Revized compensation models and bidding strategies

Popular compensation models such as pay-per-click (PPC) or pay-per-conversion are under greater scrutiny. Financial institutions may need to rethink how they bid for ad placements on comparison sites and lead generation platforms.

Impact on advertisers:

Advertisers may face higher costs per lead and will need to reallocate ad spend to maintain compliance. The shift away from preferential treatment for higher-paying providers will demand more equitable strategies, with a focus on consumer benefits rather than fees.

3. Increased liability and compliance costs

Digital marketing providers may now be classified as “service providers” under consumer protection laws, exposing them to greater liability. This will necessitate more cautious management of campaigns to avoid legal risks.

Impact on advertisers:

As compliance costs rise, marketing efforts will face increased oversight. Financial institutions will need to review their marketing partnerships and update their strategies to ensure alignment with consumer protection standards, leading to potentially higher operational expenses.

How Adthena can minimize the impact of the CFPB’s guidelines

Companies which rely heavily on third-party lead generation, may experience a dip in leads or face rising costs per lead. As a result, the key takeaway for advertisers is that they must invest more into their own advertising efforts (which they can control) to drive long-term revenue and reduce reliance on external lead generators. Here’s how Adthena’s tools can help:

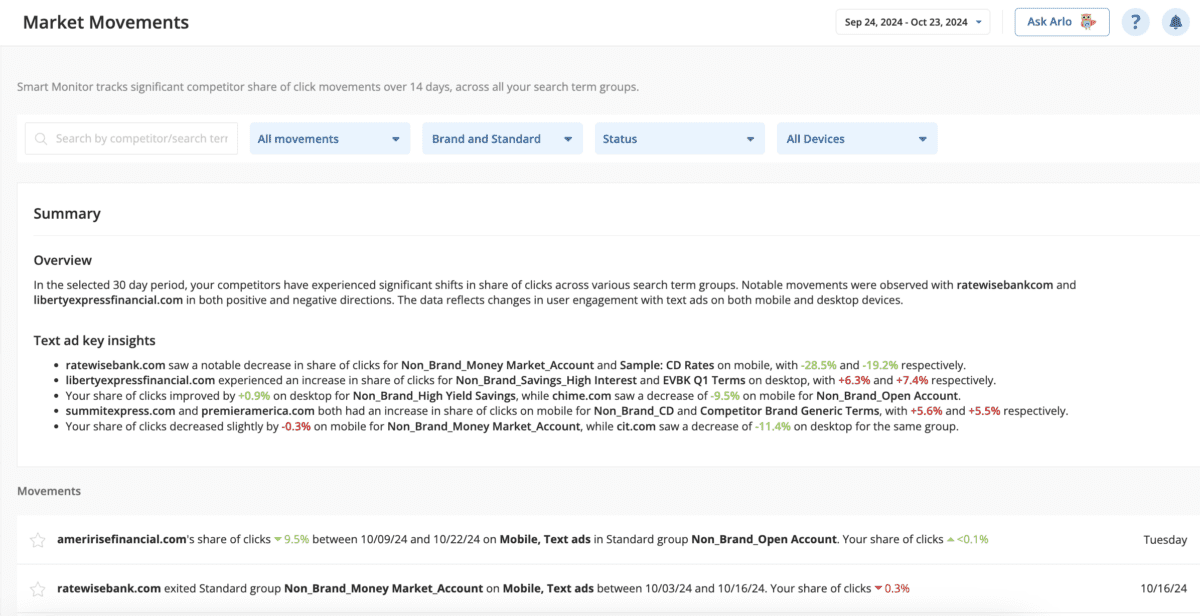

- Competitive monitoring: Adthena’s Smart Monitor provides insights into changes in the competitive landscape, market trends, or other factors that may be impacting your performance. This data allows financial marketers to pivot quickly and avoid performance dips caused by market changes.

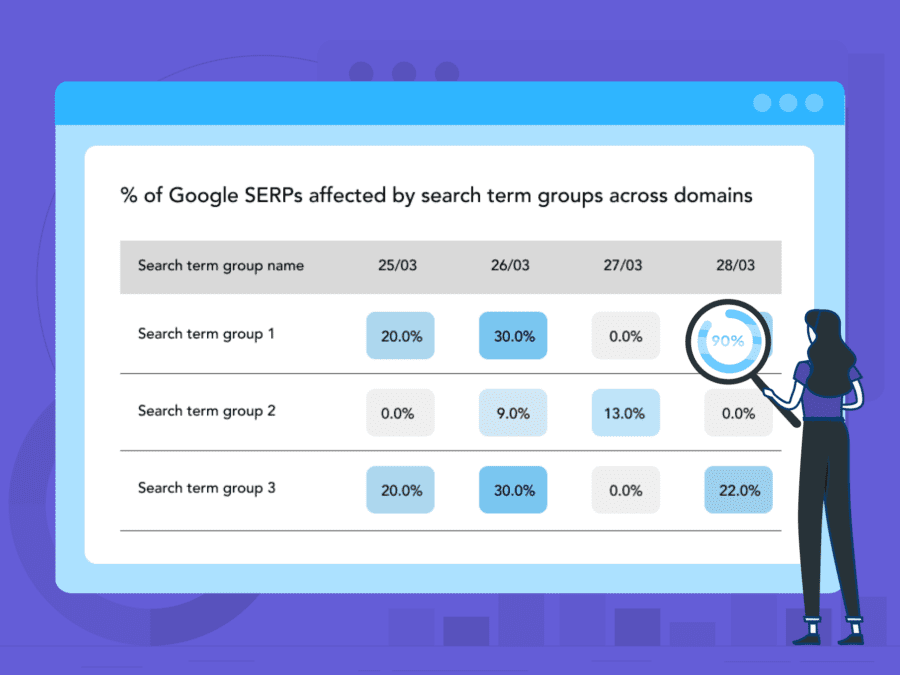

Smart Monitor tracks significant competitor share of click movements over 14 days, across all your search term groups.

- Improved ad spend efficiency: With rising compliance costs, optimizing PPC budgets is essential. Adthena’s PPC Market Trends feature can help you determine the most effective way to distribute your PPC budget based on competitive insights and market conditions.

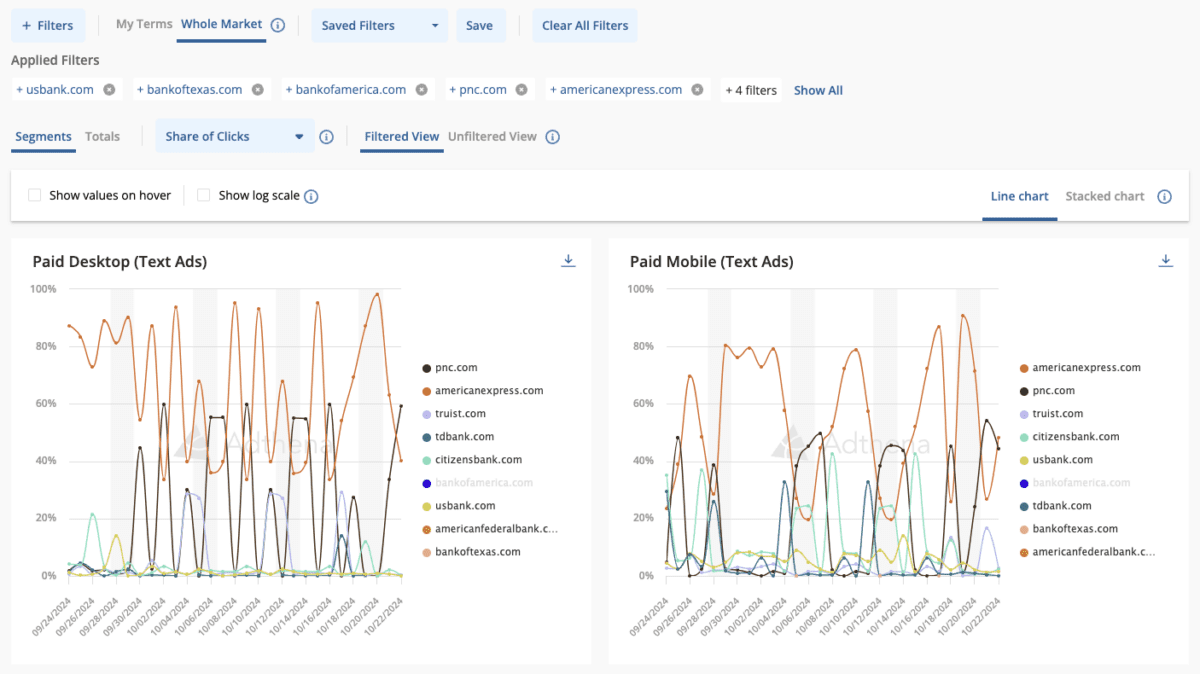

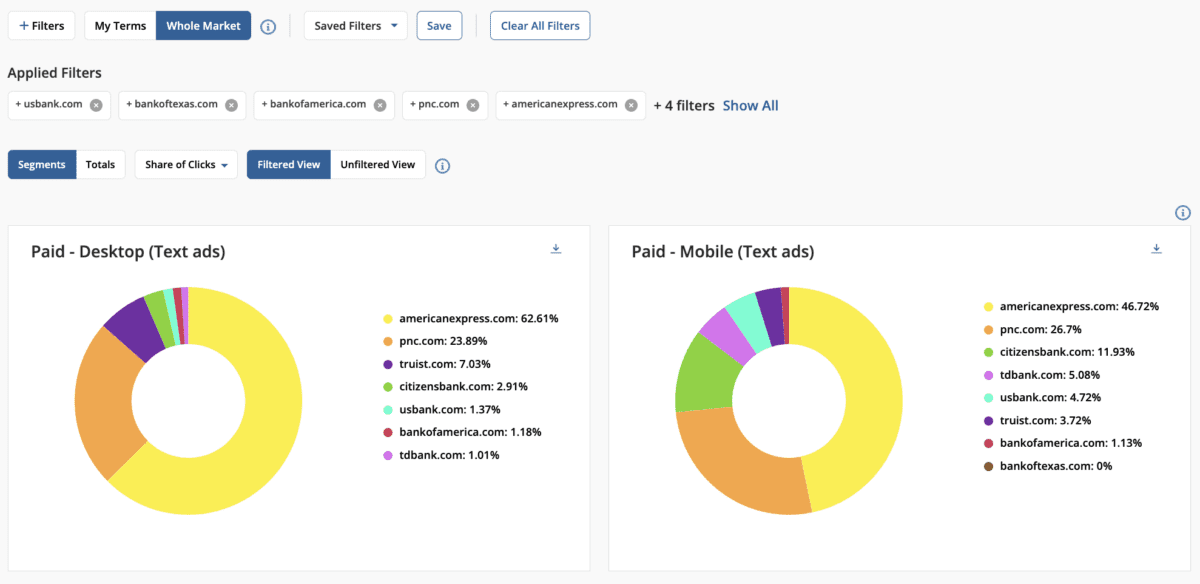

View the Share between only the selected competitors or the selected competitor’s Share versus the entire market.

- Strategic growth opportunities: Adthena’s Whole Market View identifies untapped keywords and categories with high growth potential, enabling financial advertisers to capture new opportunities and stay ahead in the market.

Whole Market View shows Market Share for competitors in the Adthena app.

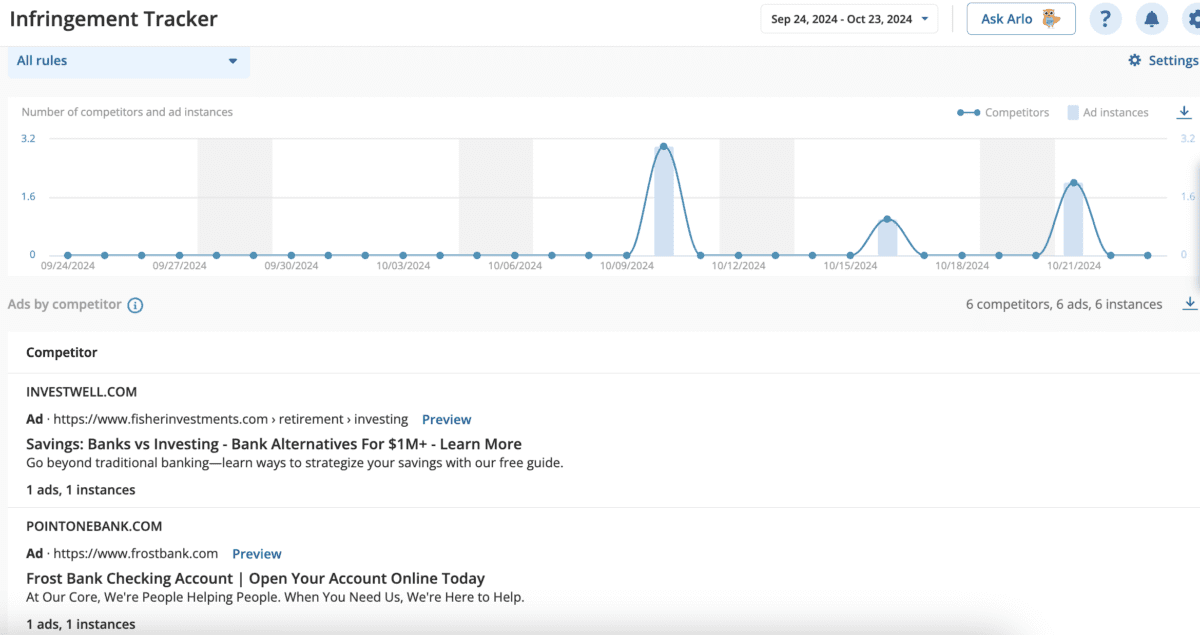

- Brand integrity and compliance: Adthena’s Brand Protection tools ensure that advertisers’ brand terms aren’t misused by competitors or affiliates, helping them avoid brand confusion, lost revenue, and potential compliance violations.

Adthena’s Infringement Tracker will track all of your brand infringements by the hour and instantly submit trademark infringement evidence to Google.

Stay ahead in paid search

As the financial industry adapts to the CFPB guidance, search intelligence will become an indispensable tool for navigating the evolving landscape. Adthena provides financial marketers with the insights they need to not only stay compliant but also outperform competitors.

Want to learn how Adthena can support your paid search efforts? Book a demo to see how our platform can help you adapt to the evolving landscape.